State Tax Revenue Growth Slowing

31 Oct 2022, by Seth Grigg Share :

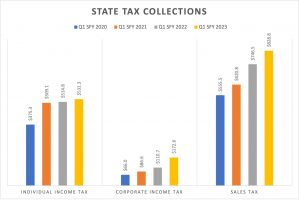

The State of Idaho released tax collection numbers for the first quarter of state fiscal year 2023 and the results paint a mixed picture. While overall state tax revenues are up compared to the same quarter last year, the growth in state tax collections came in 2% below forecast. Of note to counties, sales tax collections came in under forecast by 3.1%. The good news is that the forecast was overly optimistic and overall sales tax collections are actually up 11.8% compared to last year.

For three consecutive years, the Legislature has cut income tax rates, most recently enacting a flat income tax rate of 5.8%. These cuts have resulted in relatively flat income tax collections since 2021. Sales tax collections remain the bright spot for state tax collections, increasing 33.5% since 2021 (growing at a rate of 11% per year).

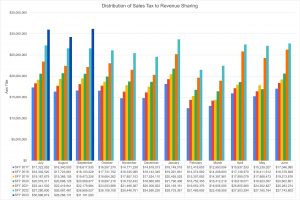

Strong growth in state sales tax collections means increased sales tax revenues sharing and Transportation Expansion and Congestion Mitigation (TECM) revenue sharing to cities, counties, and highway districts. Sales tax revenue sharing in particular continues to exceed expectations, increasing 47.8% since 2020.

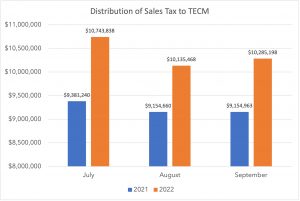

TECM is a new sales tax distribution to local highway jurisdictions including counties, highway districts, and cities. While TECM is only up 12.5%, locals will receive all the distribution growth as the amount of TECM distributed to the state is capped at $80 million. Through the first quarter of state fiscal year 2023, TECM is up $3.5 million.

State revenue sharing continues to be a bright spot for counties and county tax payers. As strong growth in sales tax will lead to a reduced property tax burden on county residents.