From the Executive Director: Week of February 13, 2023

13 Feb 2023, by Seth Grigg Share :Bill Introduction Deadline in Rearview Mirror

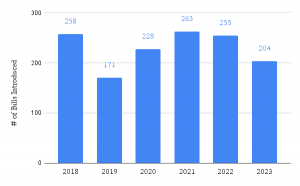

As we enter week six of the 2023 Legislative Session, the legislature is slowly picking up the pace of bill introductions. Friday marked the last day of bill introductions for non-privileged committees. With the passing of the bill introduction deadline, I researched bill introductions through the first five weeks of the session dating back to 2018. In this six-year span, 2023 comes in as the year with the second lowest number of bill introductions. To date, 204 bills have been introduced; this is down 20% from the same time last year. The median number of bills introduced through the first five weeks of the session over the last six years is 242. The chart below highlights the number of bill introductions through the first five weeks of the session since 2018.

With the bill introduction deadline now in the rearview mirror, IAC continues to work with key legislators and stakeholders on a path forward for meaningful property tax relief. Negotiations are ongoing and productive. That being said, we are probably a few weeks away from another bill introduction. Discussions are primarily focused on finding ways to incorporate funding for school bonds and levies, property tax breaks for homeowners, fixes to the circuit breaker program, and an increase to the homeowners exemption. The goal is to develop a framework that provides at least $150 million in ongoing property tax relief as well as $205 million in one-time property tax relief. IAC will share additional information as it becomes available.

IAC also continues to engage with the Governor’s Office and legislative stakeholders to find a path forward for public defense reform. The end is a little less clear on this front. There is agreement on how to move forward with counties that contract for public defense, but there is still work to do for those counties which provide public defense in house. The primary sticking points relate to the short-term transition to a new system and the level of oversight provided by the state.

Lastly, and more importantly, the House and Senate have agreed on a path forward for voting in the Joint Finance and Appropriations Committee (JFAC). The joint budget committee is unique compared to other state legislatures in that the committee meets and votes together, rather than separately. This results in greater efficiencies in developing state budgets. This year, members of the House desired to separate the committee for voting purposes. The committees would continue to meet together but vote separately rather than jointly. The Senate balked at this approach. The stalemate has delayed votes on supplemental levies. Under the new agreement, the committees will continue to meet and vote together with final votes announced separately.