What to Watch: Week 4

2 Feb 2026, by Sara Westbrook Share :A number of bills were introduced last week, so things are starting to pick up on the House side. Not many bills have been introduced on the Senate side yet. The main issue that we are continuing to track is the state budget.

Today, the House Revenue & Taxation Committee, through a party-line vote, sent House Bill 559 to the floor with a due-pass recommendation. This is the newest version of the tax conformity bill. Usually, tax conformity is the first bill out of the gate that gets passed and signed by the Governor, because of the changes implemented by the One Big Beautiful Bill (OBB) that President Trump signed into law last summer, and the difficulties that the state is having to balance the budget this year, this bill is of more interest than usual.

From the Idaho Association of Counties’ (IAC) standpoint, we are paying attention to the impacts this year’s federal tax conformity bill may have on the state budget, with a focus particularly on funding for state and local transportation dollars from the state.

As mentioned in prior newsletters, during this year’s state of the state address, Governor Little called for a one-time cut to ITD and local government transportation funds disbursed from the State General Fund. This is a $110 Million impact on local governments. If you have not had a chance to visit with your legislators about this particular issue, it is not too late. The state has not set the transportation budget yet, but JFAC may take it up soon.

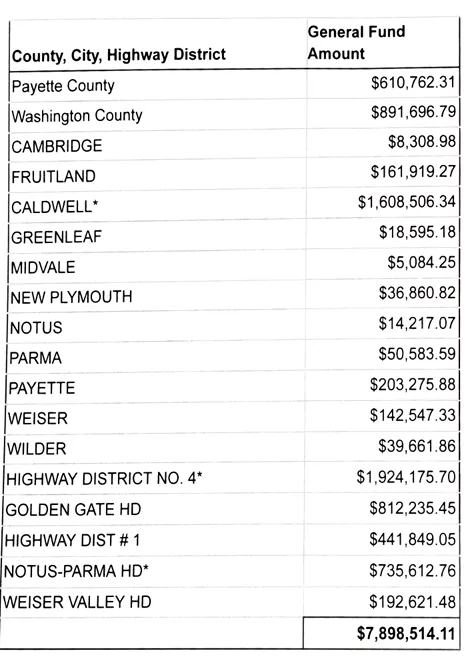

Please reach out to the legislators in your district to share how this cut would impact your local road and bridge funding. To make it easier, we have worked with the Idaho Highway District Association to produce a breakdown of the impacts by legislative district. The data is further broken down by city, highway district, and county road and bridge, so legislators will know exactly how much each local road jurisdiction will lose if this funding is cut from the state budget.

Please advocate for including a line-item in the state budget to keep at least part of this funding in place. We are concerned that if it is fully removed this year, it will be difficult to add it back as a line item to the state’s budget next year.

For information about the direct impacts of this cut to your district, find the data for your legislative district hyperlinked below. Remember, the data is taken from the general fund money that each district received last year. If you aren’t sure what legislative district you reside in, FIND YOUR LEGISLATIVE DISTRICT HERE.

| Transportation Funding Broken Down By Legislative District: |

2025 State General Fund Disbursement Example from Legislative District 9: