County Property Tax Budgets

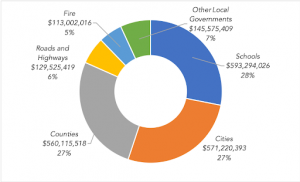

20 Dec 2021, by Seth Grigg Share :IAC has been reviewing property tax budget data for the 2021 tax year from information recently released by the Idaho State Tax Commission. The data reveals that local taxing districts levied just over $2.1 billion in property taxes for tax year 2021 (county fiscal year 2022). From this amount, counties budgeted just over $560 million, representing about 27% of the total amount of property taxes levied. School districts once again levied the most in property taxes at $593.3 million (28%), followed by cities ($571.2 million, 27%), counties, county roads and highway districts ($129.5, 6%), and fire districts ($113 million, 5%). The remaining local taxing districts levied $145.6 million (7%). The chart below visualizes the allocation of local property tax collections by district type.

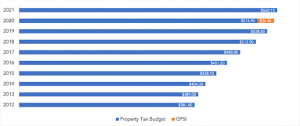

The data, when compared to similar data over the last decade, highlights a slowing of annual property tax budget increases by counties. Year-over-year, county property tax budgets increased from $516.9 million to $560.1 million. While this increase appears large, it does not reflect the $36.4 million in property tax savings last year from Governor Little’s Public Safety Initiative (GPSI). When accounting for the $36.4 million in replacement money, county property tax budgets increased a modest $8.7 million. The chart below highlights annual property tax budgets for counties from 2012-2021.

When controlling for GPSI, county property tax budgets increased only 1.2%. This marks the second year in a row in which overall county property tax budget increases were less than 3%. It also runs counter to the sentiment that county property tax budgets are rising too fast. In fact, county property tax budgets have increased less in the last two years than budget state general fund increases. The chart below highlights the annual percent change in county property tax budget increases since 2013

Prior to the start of the 2022 Legislative Session, IAC will release a more comprehensive look at the current state of property taxes in Idaho. Anecdotally, two factors appear to be helping counties in keeping property tax budget increases to a minimum. First, between Medicaid expansion and House Bill 316 passed last year, county medically indigent and involuntary commitment expenses are way down. As a result, counties have been able to pass the savings on to county taxpayers. Second, sales tax revenue sharing continues to smash records, meaning counties have additional non property tax general fund revenues to draw form. We’ll have more data to highlight these factors. Until then, please be sure to meet with your legislators and discuss with them the ways your county is working to reduce the overall property tax burden on your constituents.