From the Executive Director: Week of March 7

7 Mar 2022, by Seth Grigg Share :House Introduces Major Property Tax Reform Legislation

On Friday, March 4th, the House Revenue and Taxation Committee introduced House Bill 741 exempting owner-occupied residential property from paying most property tax levies. House Bill 741 is sponsored by House Majority Leader Mike Moyle (District 14, Ada County) and Senate Local Government and Taxation Committee Chair Jim Rice (District 10, Canyon County). If enacted, H0741 will do the following:

- Increase the state sales tax from 6.0% to 7.85%

- Exempt owner-occupied residential properties from paying nonexempt property tax levies (tax levies for schools and any voter approved levy would still be paid by owner-occupied residential property owners)

- Increase the tax credit on food from $100 to $175 per person (0.002% of sales tax collections)

- Dedicate 1.65% of sales tax collections to a Property Tax Relief Fund

- Base distributions will be dependent on property taxes levied on owner-occupied property in tax year 2021

- Base payments will be locked in after the first year of implementation

- Base payments will be increased annually by 3% (unless revenue growth is less than 3%)

- Excess payments up to 10% will be allocated to counties based on population, cities based on population, and other taxing district based on budget size

- Excess above 10% will be used for one time property tax relief for other classes of property still subject to property taxation

- Establish a Property Tax Relief Stabilization Fund to provide additional sales tax revenues to counties, cities, and other taxing districts during times of economic recession

- 15% of growth in sales tax collections to local governments will be deposited into the Property Tax Stabilization Fund

- The annual fund balance of the Property Tax Stabilization Fund will be capped at 30% of annual sales tax collections

- If the fund balance exceeds 30%, excess funds will be distributed to counties, cities, and taxing districts

- Distributions from the fund will be triggered automatically anytime quarterly distributions are 3% less than distributions from the same quarter of the prior year with no more than 50% of the stabilization fund distributed in any single year.

- The sales tax increase will take effect on July 1, 2022

- County, city, and taxing district property tax budgets will be reset for tax year 2022 to not include property taxes collected from owner-occupied properties

- Lost property tax revenues will be replaced with new sales tax revenues

- Voters will vote on an advisory vote to keep the sales tax increase during the November 8, 2022 general election

There is a lot to unpack in the bill which is 41 pages. The bill sponsors were in regular contact with IAC staff in drafting the bill. IAC did what we could to mitigate the negative impacts on counties in the event the bill passes. A detailed analysis of the bill, including the fiscal impact on counties will be emailed to county officials by close of business Monday, March 7th. After my initial review, here are the key takeaways:

- House Bill 741 likely benefits rural counties. This is because most rural counties rarely see annual property tax budget increases greater than 4%. Sales tax revenues increase on average between 6-8% per year.

- For counties considered rural centers (counties having a city with a population between 7,500 and 20,000), House Bill 741 has a neutral impact on county revenues except when there is a recession lasting more than two years.

- For commuter counties (counties with at least 25% of its population commuting to another county for work), House Bill 741 has a neutral impact on county revenues except when there is a recession lasting more than two years.

- For urban counties, House Bill 741 will likely have a negative impact. Urban counties tend to see annual property tax budget increases of 5-6%, with annual budget growth largely coming from new construction associated with owner-occupied residential properties.

- The Property Tax Budget Stabilization Fund is effective at mitigating the effects of a recession lasting less than two years but is less effective mitigating the impacts of a recession lasting three years or longer (for reference, there was a one-year recession in the early 2000s and a three-year recession from 2008-2010).

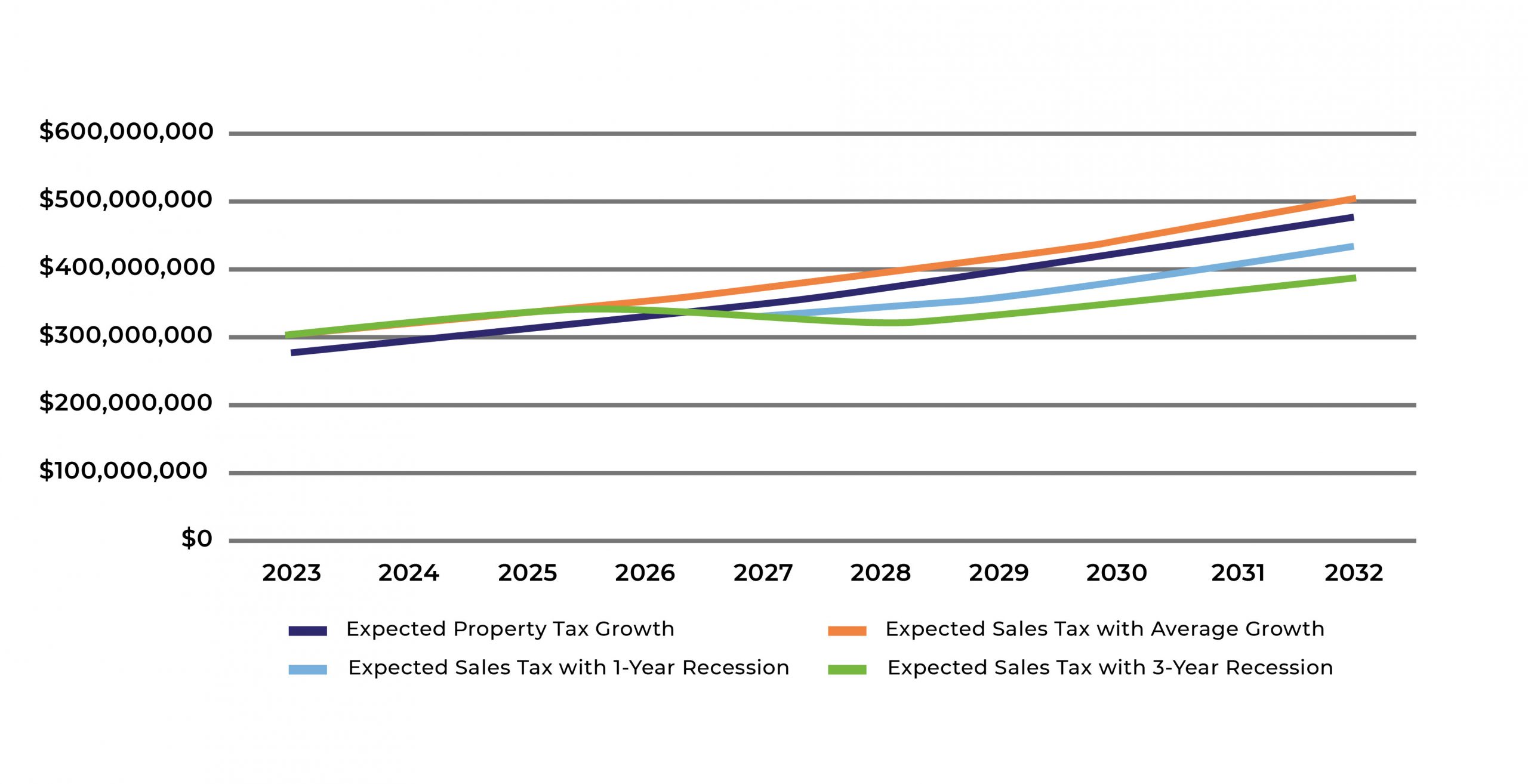

The chart below visualizes the ten-year impact of House Bill 471 on counties under three scenarios: continued annual average growth in sales tax collections, average annual growth with a one-year recession, average annual growth with a three-year recession. The three scenarios are compared to expected county property tax budget growth which is used as a means of comparing hypothetical sales tax collections under the three scenarios. (Click on the chart below to enlarge it in a new tab.)

In talking with the chairman of the House Revenue and Taxation Committee, House Bill 741 likely won’t be heard until later in the week to give time for legislators, local governments, and the public to evaluate the bill. The IAC Legislative Committee will review the legislation during their regularly scheduled Wednesday meeting. Please pay close attention to your email this week as we share vital information and keep you updated on potential legislative hearings and action.

There will be a special IAC zoom meeting on Tuesday, March 8th at 11 am MT to provide a fiscal analysis of House Bill 741. Register here.