Idaho’s County Members Take on Tampa for the 2024 NACo Annual Conference

By Kathy Ackerman, Idaho County Clerk & NACo Board Representative The 2024 National Association of Counties (NACo) Annual Conference & Exposition was held in Hillsborough County (Tampa), Florida, July 12-15. Idaho was well-represented by attendees John David Davidson (IAC 1st VP), Kathy Ackerman (NACo Board Representative), Skip Brandt (WIR Board Representative), Custer County Commissioner Steve Smith, Bannock County Commissioner Jeff Hough, Carol Moehrle (National Public Health Representative to the NACo Board), and IAC staff members Seth Grigg, Kelli Brassfield, Sara Westbrook, and…

Submit Your Proposed Legislative & Policy Resolutions to IAC by Sept. 1

Do you have a policy issue that is feasible, doesn’t create an unfunded mandate, affects more than one county, affects more than one county office, and needs a change in statute? If the answer is yes, then we encourage you to submit an IAC Legislative Resolution for consideration at the IAC Annual Conference: 2025 Proposed Legislative Resolution template. If you have an issue that does not require a change in statute and would like to see it become part of the 2025…

Rebuttal Phase of the State’s BEAD Challenge Process Now Open

By Ramón S. Hobdey-Sánchez, J.D. State Broadband Program Manager The Idaho Office of Broadband (IOB) is excited to announce the opening of the next phase of the State’s BEAD Challenge Process. The Rebuttal Phase will begin Friday, July 19, 2024. Link Up Idaho has multiple resources and tools to assist stakeholders with navigating this process and phase. Over the last several weeks, submitted challenges have been reviewed for completeness and compliance. By the end of next week, they will be uploaded for…

IAC District 2 Meeting Recap – July 2024

The IAC District 2 meeting was held on July 10th in Idaho County. The meeting began with a guided tour of the Grangeville Mill facilitated by the Idaho Forest Group. Attendees enjoyed a behind-the-scenes look at how the mill functions and learned about its daily operations. Following the tour, members traveled to the Idaho County Search and Rescue Building where Nez Perce County Treasurer Missy McLaughlin, called the meeting to order followed by the pledge of allegiance. The first item on…

Canyon County Sheriff Sworn in as National Sheriffs’ Association President

By Bert Heslington, ISA President Thursday, June 27, 2024, was a very proud and historical evening for the state of Idaho, the Idaho Sheriffs’ Association (ISA) and Canyon County Sheriff Kieran Donahue. Throughout that week, the National Sheriffs’ Association (NSA) held their Annual Conference and Presidential Banquet in Oklahoma City, OK. During the inauguration ceremony, Sheriff Donahue was sworn in as the 84th President of the National Sheriffs’ Association. This is the first time that a sheriff from the state of…

IAC Announces 2024 Scholarship Award Recipients

The Idaho Association of Counties (IAC) has named the 2024 recipients of the IAC Scholarship. After a competitive review process, seven students from across the state of Idaho were selected from a pool of 45 applicants to each receive a $1,000 scholarship from the IAC Scholarship Fund. Award Recipients: – Eloise Shelton, Senior, Clark Fork High School, District 1; – Gretchen Stokes, Senior, Deary High School, District 2; – Rhianna Iveson, Senior, Council High School, District 3; – Makaya Boyer, Freshman,…

Idaho Transportation Department seeks feedback on draft seven-year transportation plan

By Megan Jahns, ITD Communication The Idaho Transportation Department (ITD) is seeking feedback on the just-released draft Idaho Transportation Investment Program (ITIP). The ITIP outlines the state’s transportation priorities and guides investment decisions for the next seven years through 2031. ITD encourages everyone to review the draft and provide comments July 1-31. Transportation projects included in the draft ITIP range from large-scale interstate improvements to smaller projects like the installation of new guardrail. Projects are located throughout Idaho’s 44 counties and…

IAC Welcomes New Events Coordinator

We are thrilled to announce the addition of IAC’s new full-time Events Coordinator, Savannah Renslow! Savannah brings a wealth of experience to the association, having served as the Communications Director for the Idaho Association of Highway Districts for the past six years and earning both her bachelor’s and master’s degrees in Political Science from Boise State University. An Idaho native, Savannah is passionate about her community and local government and will undoubtedly make a tremendous impact on Idaho’s counties in…

Commissioners and Clerks Meet in Idaho Falls for 2024 IACC Annual Conference

The Idaho Association of Commissioners and Clerks (IACC) gathered for their 2024 Annual Conference in Idaho Falls. The three-day event began on Tuesday, June 4th and kicked off with IACC President Denis Duman addressing the group and leading them through the Pledge of Allegiance and invocation. Bonneville County Commissioner Bryon Reed concluded introductions by welcoming the group to Bonneville County. The first day offered commissioners and clerks two workshops that afforded credits as part of IAC’s County Officials Institute (COI). “Crisis…

Board of Canvassers Certify Idaho Primary Election Results

The Idaho Association of Commissioners and Clerks (IACC) met in Idaho Falls this week for their Annual Conference. During the event, Idaho Secretary of State Phil McGrane, Idaho State Controller Brandon Woolf, and Idaho State Treasurer Julie Ellsworth met with county clerks to canvass election results for the 2024 Idaho Primary Election. The purpose of the canvass is to officially account for every ballot cast to ensure that every vote is counted correctly. Idaho counties that participated in the post-election audit…

IAC Partners with Previ to Offer Member Benefits on Mobile Plans

As part of IAC’s commitment to connecting trusted business partners with Idaho’s county elected officials and staff, we’re thrilled to announce a new partnership with Previ that will provide significant cost-saving benefits to IAC members and their families. Previ offers an exclusive membership with superior prices on cell phone service and plans, among other benefits. Partnering directly with T-Mobile and AT&T, Previ members and their families enjoy unlimited-everything mobile plans at lower costs. Those moving to a Previ membership plan save…

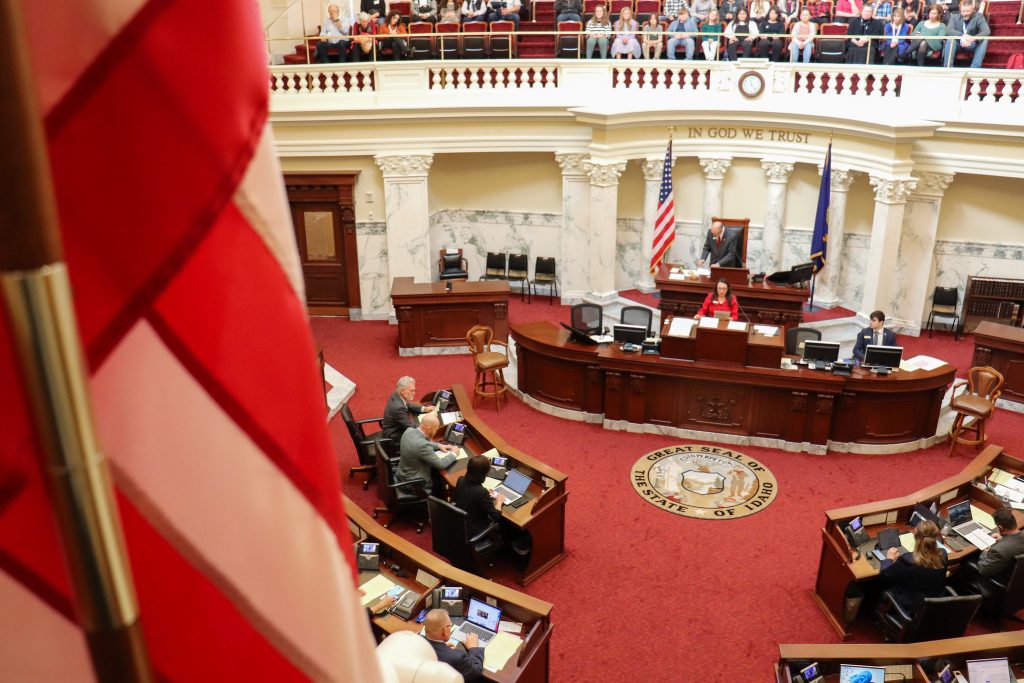

Primary Election Results in Senate Leadership Shakeup

The Idaho Primary Election on Tuesday was marked by numerous legislative match-ups decided by narrow margins. This year, more Republican and Democratic incumbents faced challengers than in the past, resulting in a significant shift. Sixteen incumbents were unseated, including some who had won against past House and Senate members in prior elections. These challengers, many of whom were grassroots candidates or represented emerging political movements, underlined the magnitude of the changes. Senate Pro Tempore Chuck Winder, currently serving his 8th term,…

County Elected Official Turnover Remains High

In January, 34 newly elected county commissioners will take office. This follows newly elected 33 county commissioners being sworn into office in January 2023. In other words, in just over two years, counties have seen a 50% turnover rate in county commissioners. Most of the turnover is due to sitting county commissioners choosing not to run for reelection. For example, of the 34 newly elected county commissioners that will take office in 2025, only eight will be the result of knocking…

2024 IAC Spring County Officials Institute Recap

The 2024 Idaho Association of Counties (IAC) Spring County Officials Institute (COI) concluded after four training sessions around the state. IAC policy staff traveled to Burley, Idaho Falls, Coeur d’Alene, and Boise in the month of May. These trainings offered county officials and staff an overview of the 2024 Legislative Session, the nuts and bolts of local government budgeting, and financial best practices. The legislative overview focused on several significant changes affecting Planning and Zoning, including Area of Impact, City Annexation,…

Idaho County Members Visit California for 2024 WIR Conference

By Steve Smith, Custer County Commissioner County elected officials and staff from Idaho ventured to Mariposa County, California, to participate in the National Association of Counties (NACo) 2024 Western Interstate Region (WIR) Conference. The event, held May 7 – 10 at the Tenaya Lodge in Yosemite National Park, brought together county officials from across the nation to focus on pressing issues facing Western counties and residents. Each year, counties within the fifteen Western states – Alaska, Arizona, California, Colorado, Hawai’i, Idaho,…

2024 IAC Salary & Benefits Survey Now Available

The 2024 IAC Salary and Benefits Survey is now available for electronic download. IAC surveyed all 44 counties and a total of 40 counties participated in this year’s survey. The electronic survey is available in an excel spreadsheet so that our members can use the data how they see fit. If you find any errors, please contact Chase Christensen, IAC’s research analyst, and he will get the corrections made. Thank you for your participation in this year’s survey. We had a…

IAC District 4 Meeting Recap – May 2024

The IAC District 4 meeting was held in Camas County on May 9th, 2024. Minidoka County Commissioner Wayne Schenk started the meeting off with roll call and the pledge of allegiance. Following the introduction, Minidoka County Treasurer LaVonna Dayley was sworn in as IAC District 4’s secretary/treasurer. Meeting attendees also discussed nominations for the recipient of the H. Sydney Duncombe Award—IAC’s highest honor for excellence in county government. Chief Deputy Secretary of State Nicole Fitzgerald gave a presentation on upcoming election…

Leader, Advocate, Friend – Dan Chadwick’s Legacy in County Government

With the recent passing of Dan Chadwick, the IAC family lost one of its fiercest advocates for county government. I first met Dan not long after graduating from Boise State University (BSU), while he was serving as the Idaho Association of Counties (IAC) executive director. Dr. Stephanie Witt, a professor in BSU’s Master of Public Administration (MPA) program, suggested I reach out to Dan about a potential opening with IAC. I took her advice, and soon after I was brought in…

IAC’s Board Members Meet in Moscow for Planning & Development

By Oneida County Assessor Kathleen Atkinson The IAC Board of Directors met in Moscow, Idaho, for their Spring Board Planning and Development Meeting on April 25, 2024. Attendees were welcomed by Vic Pearson, IAC’s president, who provided an overview of the agenda. Roll Call was then taken by Mark Bair, IAC’s 2nd vice president. Board members discussed the possibility of partnering with two new businesses, Previ and BuyBoard, whose services may benefit counties and save time and money in the long…

IAC Publishes 2024 Legislative Review

The 2024 Idaho Legislative Session concluded with a flurry of activity, leaving a mark as one of the most notable sessions in recent history. The Idaho Association of Counties (IAC) Legislative Committee, under the steadfast leadership of Chair Twin Falls County Commissioner Don Hall and Vice-Chair Ada County Commissioner Tom Dayley, convened 12 times, diligently tracking over 100 bills and taking stances on 29, showcasing a robust commitment to county interests. Notably, 14 out of 20 bills actively supported by…